Going From Gold Rush to Gold Melt

Last updated:

In the early days of our Republic, it took Congress a while to come up with legislation that produced a stable monetary system. An excellent account is found in The Guidebook of United States Coins, also known as the Red Book. You find out gold was discovered in North Carolina and Georgia. Mints in those states, plus Louisiana and Philadelphia, produced America’s earliest gold coins, including $10 coins featuring an eagle on the reverse.

But the 1848 discovery of gold in California changed history. It cascaded into the Gold Rush of 1849. It prompted Congress to pass the Coinage Act of 1849. And that law introduced two new denominations of gold coins. One was the dollar. The other was the $20 Liberty Head. It was nicknamed “double eagle” because it was twice the value of the initial $10 gold coin.

The following year, California became the 31st state. As 1850 picked up steam, nuggets glittered in miners’ pans. Veins of gold were chiseled from the Sierra Nevada Mountains. With yields so plentiful, the U.S. Mint opened a branch in San Francisco in 1854. One newspaper account estimated that $90,000 in “double eagles” were rolling off the new coin press every hour.

The Gold Vibe

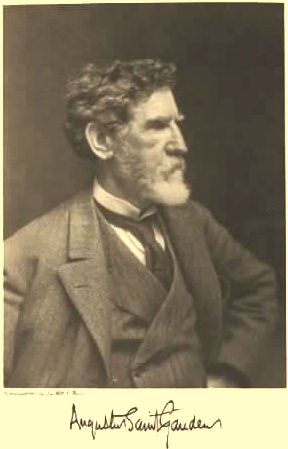

Gold Rush coins provided a canvas for engravers whose other talents enhanced their coin designs, such as portraitist James B. Longacre; watchmaker Robert Scot; inventor Christian Gobrecht; and sculptors Bela Lyon Pratt and his teacher, Augustus Saint-Gaudens, who had started his apprenticeship as a cameo cutter.

Their coin designs are found on the $1.00; $2.50 (nicknamed quarter eagle); $3.00 (gold Indian Princess); $5.00 (half eagle); $10.00 (eagle) and $20.00 (double eagle).

There’s no denying gold represents power and prestige. And, because of its resistance to heat and acid, gold also is a symbol of permanency. Observed James Blakely, founder in 1858 of the Eureka Mine southeast of Sacramento, “Gold is forever. It is beautiful, useful, and never wears out. Small wonder that gold has been prized over all else, in all ages, as a store of value that will survive the travails of life and the ravages of time.”

But did gold survive?

The 1933 Gold Recall

In 1929, the stock market collapsed. Wall Street lost 90% of its value. In its long wake, 300,000 companies went bust. One in four Americans lost their job, and 11,000 banks failed. The Great Depression was on.

By February 1933, a run on gold currency was underway as “…individuals and firms preferred holding metallic gold to bank deposits or paper currency. Some of the gold flowed to foreign nations… the internal and external drains consumed the Federal Reserve’s free gold,” according to the Federal Reserve’s online history.

Promising Americans “a new deal,” Franklin D. Roosevelt was sworn in as president on March 4, 1933. But when the Federal Reserve Bank of New York’s gold reserve fell below the legal limit, FDR – acting on a recommendation from the Reserve’s governing board – suspended all banking operations from March 6-13.

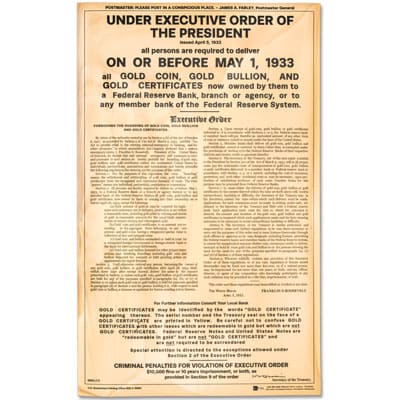

His next step was to issue Executive Order 6102, demanding all gold coins, bars and gold certificates in denominations greater than $100 be turned in for dollars at the then-rate of $20.67 per ounce. The order was punishable by a fine of up to $10,000 or up to ten years in prison, or both.

The exception?

“Gold coin and gold certificates in an amount not exceeding in the aggregate $100 belonging to any one person; and gold coins having a recognized special value to collectors of rare and unusual coins.”

By May 10, 1933, the federal government had taken in $300 million in gold coins and $470 million in gold certificates. The coins were melted into gold bars weighing 400 troy ounces each and stored at the United States Bullion Depository in Kentucky, next door to the U.S. Army command, Fort Knox.

The subsequent Gold Reserve Act of 1934 raised the price of gold to $35.00 per ounce, allowing the federal government to declare a profit of $14.33 an ounce as it worked to reset the economy.

The Survivors

It wasn’t until December 31, 1974 that President Gerald Ford repealed Roosevelt’s 1933 gold recall. By that point, estimates of gold coins – in any grade – that had survived the melting pots were an important factor in determining the value of remaining gold coins. Here are three to dream about owning one day:

1890-CC Gold $20 Liberty Head Double Eagle: Among the most elusive of coins, less than 3% of all $20 gold pieces struck from 1870-1893 were issued by the Carson City Mint in Nevada. Using gold from the legendary Comstock Lode, only 3,325 coins are believed to have survived FDR’s recall.

1908 Saint-Guadens $20 Gold Piece: From its intro in 1907 through most of 1908, this stunning “double eagle” designed by the renowned sculptor did not carry the motto in god we trust.

1928 Indian Head $2.50 Gold Quarter Eagle: Designed by sculptor Pratt (mentioned above), this coin bears an unusual incuse design. All lettering and images are recessed below the flat surface of the coin. But numismatists criticized Pratt’s design as “uninspired,” which may be why so many were turned during the 1933 recall. To date, NGC, the independent grading service, has certified a total of 3,534 in Choice Uncirculated condition from the total 416,000 minted in 1928.

No doubt about it: Gold coins are the ne plus ultra of coin collecting. Their prices reflect their quality and their rarity. And, our aspirations.

This article was written by Helen P.

An adventurous time-traveler, Helen P. is an author of numerous regional history books.